For the BBC there seems to be no ‘why’ for 7/7.

Or at least when listening to their coverage of the anniversary one thing is missing….the question asking what was the motivation for the attacks, why did 4 Muslims attack ‘The West’?

The BBC looks even to have put aside its normal infantile, dangerous and highly politicised reason…the Iraq War….The BBC knows this is a false message, a deliberate lie by the BBC intent on hiding the real reasons for ‘radicalisation’.

In its place there is a constant stream of remarks about ‘young British lads’, though not ‘Muslims’, and thoughts that we musn’t ‘demonise Muslims’. …repeatedly emphasising this quote from Baroness Manningham-Buller, ex-director-general of MI5:

“I think we’ve got to be very careful not to demonise the Muslim community, quote unquote – I’m not sure there is a Muslim community – there are a lot of British Muslims from all sorts of communities.

“From the time I was in the service successes often depended on British Muslims giving us information in confidence – often at risk to their lives – and Muslim members of staff helping us to understand these issues. And therefore I think labelling whole communities is not wise.”

[Always odd how it is always claimed that the Jihadists are not Muslims and yet the cause of radicalisation is Muslim anger….so at what point do ‘angry Muslims’ become ‘apostates’ and join the ranks of the infidels? Just where is that line when a Muslim becomes a non-Muslim?]

Is it demonisation to ask why the ‘Muslim community’, and it is ‘credible’, mainstream community leaders who push this message, consistently sends out a message about being angry about British foreign policy and that this is the cause of radicalisation….in effect reinforcing the message of the Jihadi recruiters with the same message…..the same Muslim community that thinks 9/11 and 7/7 were conspiracies by intelligence agencies, the Jews or this government….so much so that the BBC had to put out a film showing such beliefs about 7/7, spread by mainstream Muslim leaders, were completely wrong.

Here is an image from a BBC report into 7/7 many years ago titled ‘It starts here: Street campaigning and agitation, late 1990s’….. ‘It’ of course being Muslim radicalisation…..

The BBC knew the real reasons for radicalisation and yet, despite that report, still pushes the message about the Iraq War so the same questions that are asked of the Muslim communty can of course be asked of the BBC and its message about the Iraq War, a ‘war against Islam’ and Britain’s, the West’s, ‘history of ancient wrongs’ against Muslims.

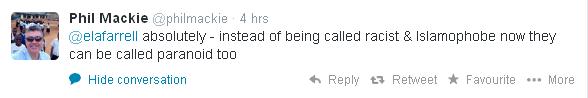

Fresh from blaming the Jews for making themselves targets it may be somewhat galling for people to see the BBC now fawning over the survivors and the families of victims of 7/7 when the BBC has done so much to promote the Jihadi cause, just as some people may have been surprised if not angered by having the BBC’s Phil Mackie sent to report on and sympathise with the relatives of those killed in Tunisia…the same Phil Mackie who made it his job to downplay the Trojan Horse plot and attempt to dismiss it as the work of racist, paranoid Islamophobes….

…and who admitted that he tried to avoid using the words ‘extremist’or ‘Islamist’ in relation to the story…thus covering up the motivation behind the plot…and the fact that ‘conservative’ Islam,, ie Islam, is in relation to a Western democratic, secular society ‘extreme’.

…and who admitted that he tried to avoid using the words ‘extremist’or ‘Islamist’ in relation to the story…thus covering up the motivation behind the plot…and the fact that ‘conservative’ Islam,, ie Islam, is in relation to a Western democratic, secular society ‘extreme’.

Of course it wasn’t just Mackie but the BBC itself that tried to paint the plot as a hoax….the BBC coming up with this infamous lie…

It was alleged last year extremists had tried to take over several schools in Birmingham to advance radical interpretations of Islam.

A series of official investigations found the claims to be groundless.

Really?…….from yesterday….

Peter Clarke was head of the Counter Terrorism Command at Scotland Yard from 2002 until 2008

7/7 bombings: Why we can never stop tackling extremism

There can be no room for complacency.

Last year, I was asked to conduct the so-called Trojan Horse inquiry into allegations of infiltration of schools by Islamist extremists. The evidence was clear that there were people in positions of influence in some schools in Birmingham who held intolerant and extremist views.

Extraordinarily, the Commons education select committee published a report earlier this year saying that only one, isolated example of extremism had been found. This flew in the face of the evidence, and the Government has now firmly rejected the report, saying that it “downplays the seriousness of events in Birmingham and risks undermining our efforts to tackle extremism”.

The tragic irony is that this government rebuttal was issued on the day that 39 people were murdered on a Tunisian beach by a man whose route to terrorism may have started with someone telling him that intolerance of others’ beliefs and values is a virtue.

Despite that even yesterday’s BBC’s report of the Government reaction still plays the same game it played before…

The government has claimed MPs risked undermining efforts to tackle extremism by downplaying the seriousness of the “Trojan Horse” events in Birmingham.

Several inquiries and investigations were launched after an anonymous letter surfaced last March containing instructions for installing sympathetic school governors.

It has since been regarded as a hoax in some quarters and claims made about a number of schools named in the letter have been deemed groundless.

Perhaps the politicians are right and the BBC needs to pick a side…..the Jihadis or Western Society….many people might suggest the BBC already has picked a side…that of the Jihadis.

Max Keiser

Max Keiser

Jamie Angus

Jamie Angus